Another good catch by Steve Mufson at the Washington Post on the world of subsidies. Mufson earlier did great work to expose the games Congress was playing on loan guarantees to "advanced" energy to boost the level of credit support that would ultimately be available to large scale power producers like nuclear and coal plants.

His most recent piece explores the potential expansion of lucrative cellulosic ethanol tax credits to black liquor byproducts in the paper industry -- an outcome that the exposure in the Washington Post will make far less likely. The article also provides some useful reminders on the nature of subsidy creation in the United States.

First, new subsidies can arise in virtually any bill that goes through Congress. Trying to figure out the logic of alternative energy tax credits in a Health Care Bill? Don't think subject matter; think about political power and probability of success. The more important a piece of funding legislation is, the higher the likelihood it will get through Congress, and the more desirable the vehicle becomes to carry lard large and small.

Second, the story once again illustrates how obscure changes in statutory language or interpretation can have enormous fiscal implications for the country, and concomitant inter-sector economic distortions. Mufson notes that the provision in question had a 10-year estimated cost to the Treasury of nearly $24 billion based on analysis by the Joint Committee on Taxation (JCT). (JCT is the group slated by Congress to estimate the tax cost of pending legislation, and one of two government agencies estimating the tax costs of existing laws in the US).

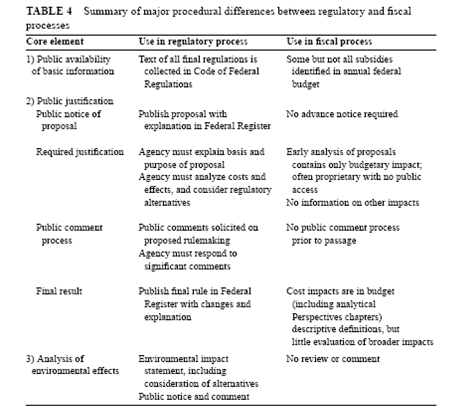

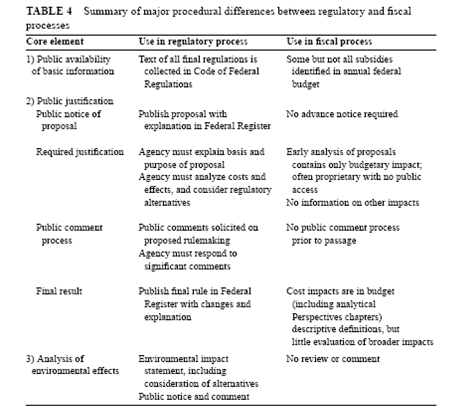

Third, there remains an enormous disparity between the requirements to expose, analyze, and evaluate options to policies implemented to protect human health and the environment, and the minimal disclosure and discussion required even for massive new fiscal subsidies. This disparity becomes increasingly important in the climate change arena where binding constraints on greenhouse gas emissions are a prerequisite for structural change in the economy. Yet these constraints can be weakened in so many ways, often with very little visibility.

An earlier discussion of this problem can be seen in a paper (see also table below) that I wrote with regulatory expert John Dernbach of Widener Law School. The core issue on differential transparency unfortunately remains mostly unchanged today. The distinctions in oversight requirements between these two types of policies may have historical reasons, but certaintly make little rational sense. These subsidies can and do create the very problems to human health and environment that regulatory interventions are later proposed to address.

Source: Doug Koplow and John Dernbach, "Federal Fossil Fuel Subsidies and Greenhouse Gas Emissions: A Case Study of Increasing Transparency for Fiscal Policy," Annual Review of Energy and the Environment, 2001, V. 26:361–89.