One important provision dropped from the Senate's "compromise" tax bill was a requirement that the the Joint Committee on Taxation and the Government Accountability Office actually evaluate tax provisions regularly "extended": by Congress to see if they are accomplishing what they were originally intended to accomplish.

Citizens for Tax Justice notes that these provisions amount to nearly $30 billion in revenue losses each year. Periodic evaluation of efficacy seems the very least the taxpayers granting this largess deserve. More on the issue from Seth Hanlon at the Center for American Progress.

Regulatory activity by the federal government to accomplish such goals as protecting human health or environmental quality must run through a wide array of review to assess the costs and benefits of the proposed options and whether there are less expensive ways to reach the same goals. If the affected sectors don't think these assessments have been well done, they can (and often do) litigate.

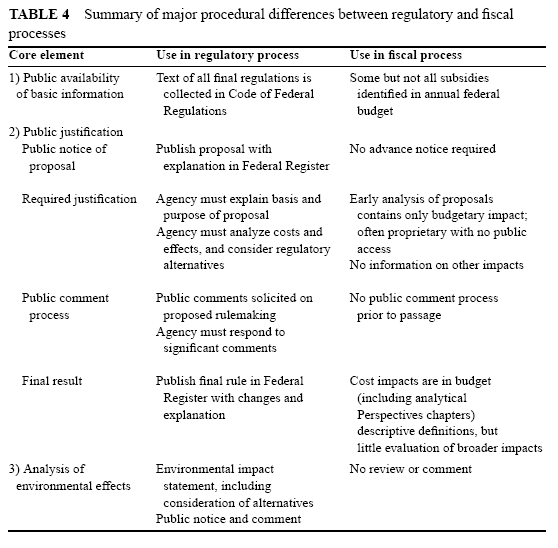

Not so with fiscal subsidies such as tax breaks. The table below (from this article by Koplow and Dernbach) starkly demonstrates the lack of transparency that plagues multi-billion dollar fiscal subsidies. Federal fiscal subsidies are often larger in economic impact than government regulatory actions. Yet they subject to far less evaluation and review. It is high time for this to change.