Below is an article on the end of VEETC titled "Looking at Life With an Ethanol Subsidy," published in Farm Futures on December 28th. In only a few short paragraphs, it captures so much of the industry spin on these issues over the years that is provided a great framework for calling them out. A link to the article is here.

The ethanol industry is probably not caught unawares by the end of the Volumetric Ethanol Excise Tax Credit, but it's quiet expiration as 2011 winds down - under the hubbub of job creation bills and debt ceiling limit raising - will not go unnoticed by the industry.

The end of VEETC also brings along an end to the 54-cent-per-gallon tariff on imported ethanol, which may not be an issue given that Brazil is buying plenty of U.S. ethanol to burn in its cars (the country's vehicles are predominantly flex-fuel in design and they burn a lot of ethanol).

It will be interesting to see how the Brazil-US trade plays out over time. The end of the tariff should make it easier to import sugar ethanol from Brazil, and over the longer-term, ethanol production from sugar cane in a tropical region is expected to be more efficient than US corn. As the RFS becomes more binding (expected as a byproduct of the elimination of VEETC), it could well start pulling fuel flows back from Brazil to the US, as has been the historical norm. There has been quite a bit of controversy on whether US exports have tapped the blender's credit before heading offshore, as well. Industry said no; others disagreed. That debate will now end, as nobody will get the blending credit. If we see reversals in the direction of trade that are both rapid and large, we'll know that exporters were, indeed, getting the credit in the past.

What many consumers don't realize is that the tax credit didn't go to ethanol plants, it went directly to oil companies as they splash blended ethanol into the truck to head for the local gas station. As the tax credit expires, fuel providers will raise their prices to cover, and consumers may be surprised. It doesn't mean less ethanol will be used, since the biofuel is a mandated oxygenate in many states - at the 10% level.

The corn and ethanol industries love to say that the tax credit went to oil companies. This is the point of market incidence, where the credits were paid -- like PayPal collecting funds related to a sale on Ebay that will ultimately be forwarded to another party. This is by no means necessarily the point of economic incidence -- i.e., which market player ultimately ended up with the financial benefit of the tax credit. The fact that the corn and ethanol industries long fought the end of VEETC, while the oil industry didn't, says quite a bit on which party was more likely to be benefitting economically from the credit. Further, the article's claim that prices will rise to cover the loss of VEETC also indicates that it was ethanol getting the subsidy, not the petrol part of the fuel mix.

The fact that ethanol remains mandated (both by oxygenate rules in some states as the article mentions and by the Renewable Fuel Standard), means that we aren't likely to see a sharp loss in competitiveness for ethanol and declining market share following the end of the blender's credit. Consumers are still required by law to buy the stuff after all, even at higher pump prices. We are merely seeing a subsidy shell game: lower tax subsidies (borne by taxpayers) shifted to higher prices on the tradable RFS credits, called RINs (borne by fuel consumers).

Corn growers have supported the end of the credit as a way to help reduce the federal deficit, but as one corn group notes the oil companies "didn't follow suit and offer up their own century-old petroleum subsidies as a budget-saving measure."

Yeah... A large subsidy exists for more than 30 years, is renewed multiple times, including during a bloody battle in 2010, and the corn growers claim the loss of VEETC was voluntary. The article was mere text. But if it had been video, I doubt even they could have put forth this claim with a straight face.

None of this is to go against the corn growers' argument that fossil fuel subsidies should be eliminated, of course. They should be, and hopefully will be. But let's be clear: VEETC didn't die because the corn growers were taking one for the team; oil and gas subsidy elimination will no doubt require an ever bigger fight. Second, the end of VEETC by no means ended subsidies to ethanol. Hence the title of the article referring to the end of "an ethanol subsidy" rather than the end of "ethanol subsidies."

In my view, the successful elimination of VEETC had two main pillars. The first, and probably most important, was the splitting of the farm lobby as surging grain prices led the feed industry and food producers to have interests that diverged sharply from the fuels and corn groups. This led to the establishment of a new set of trade associations, new patterns of political funding and pressures, and some interesting political alliances with environmental groups (concerned about environmental impacts of scaling biofuels on land and habitat) and development groups (worried about domestic SUV owners outbidding poor residents of the developing world for the caloric content of grains). Congressmen who might previously have had misgivings about the support for corn ethanol now had cover to begin taking positions against continuing the policy.

The second pillar allowing the end of VEETC is the recognition, even by the industry, that the vast majority of subsidies that VEETC had provided will remain through higher RIN prices under the RFS, and that the industry will not face a shake-out from subsidy removal because the subsidy isn't really disappearing. Some producers will probably be worse off, but it won't be industry-wide.

The math on oil company economics of ethanol use are pretty clear. In a press release from the Illinois Corn Growers Assocation, Jeff Scates, president, notes that for the last four years ethanol has been less expensive than gasoline so when oil companies use ethanol "they're already making a gallon of gas cheaper to produce. The VEETC was worth about 4.4 cents per gallon at the 10% blend. That's the price advantage that's lost starting January first. It's not the ethanol that might make gas prices go up, it's the loss of the VEETC."

Aside from some adjustments to these numbers that might be needed to reflect ethanol's lower energy content, the article seems to be acknowledging that any cost advantage ethanol held to conventional gasoline was due to a tax subsidy. Oops. To me that seems to say that the requirement to use ethanol is making the price of gasoline go up.

It's the end of a 30-year ride for VEETC, and the ramifications are not completely known. Industry groups report that ethanol plants will go on, but how consumers react to a 5-cent gas price rise on Jan. 1 remains to be seen.

With the fiscal mess the country is in, it is high time to see the end of many more "rides" like this one. On the specifics of VEETC, I'm not expecting riots come January 1st. Changes on this scale are in the noise of normal shifts in the price of a gallon of gas. More important policy-wise is ensuring that if the mandates stay in place they are accurately integrating environmental impacts, and that the environmental thresholds fuels must meet to get this subsidy become more stringent over time. Ideally, though, we see an end to balkanized transport subsidies and force all methods for reducing gasoline per vehicle-mile travelled to compete on equal footing.

UPDATE, Jan. 3, 2012

A few more quips on the VEETC expiration. Here's Matt Hartwig of the Renewable Fuels Association talking of the industry's magnamity in the New York Times:

“We may be the only industry in U.S. history that voluntarily let a subsidy expire...The marketplace has evolved. The tax incentive is less necessary now than it was just two years ago. Ethanol is 10 percent of the nation’s gasoline supply."

In response to a question about how the loss of the subsidy might affect prices and supply, Mr. Hartwig said: “We don’t expect the price of corn to fall or rise just because the tax incentive goes away. We will produce the same amount of ethanol in 2012 as in 2011, or more.”

Gee -- loss of a big tax subsidy, yet no change in the markets for corn or ethanol? How is that possible? After all, Scientific American noted that for the first time in 2011, more corn was being used for fuel than for feed to domestic animals (it passed human consumption long ago). Hartwig knows, of course, that his markets are protected by the mandates and only the form of subsidy has changed. And so the spin continues.

NRDC's Sasha Lyutse was also irked by the industry's claims that it was taking the high ground on subsidies. She compared industry statements from a year ago (when they had a chance to keep VEETC alive) with their current stoic communalism:

It’s actually fairly amusing to take a page out of Jon Stewart’s book and contrast industry statements from 2010—when corn ethanol lobbyists were issuing dire warnings that equated ending the VEETC with “pushing the industry off a cliff”—with statements over the last few months, as corn ethanol proponents pulled a sharp 180 and started telling anyone who’d listen just how much they didn’t need or want the VEETC.

Here’s Renewable Fuels Association President Bob Dinneen in July of 2010:

“Now is not the time to add uncertainty and complexity to the energy tax debate. Because the EPA has failed to act to allow higher level ethanol blends, margins in the industry are razor thin. Losing the tax incentive now will shutter plants and cost tens of thousands of jobs.”

And here’s American Coalition for Ethanol Executive Vice President Brian Jennings on that same day:

“If Congress fails to extend ethanol tax incentives beyond 2010, more U.S. jobs will be lost and energy independence will be reversed, two dangerous consequences that America cannot afford.”

Compare that to the industry’s current spin, like this statement from Poet CEO Jeff Broin just a few weeks ago:

"Ethanol is now able to compete with gasoline without a tax break…Today, ethanol is so competitive that we have become a major exporter, even to Brazil."

And the National Corn Growers Association last month:

“VEETC expires about a month from now, and corn growers and the ethanol industry have long agreed to let it expire and have since stopped fighting for its renewal...Frankly, we left this game last quarter because there are other, smarter ways to support ethanol, especially in today’s deficit-prone political world.”

You’d almost think someone forced them to spend millions lobbying for a VEETC extension!

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on

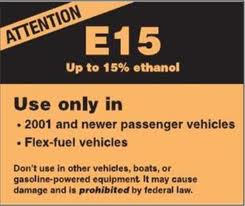

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?