It's an interesting time to watch biofuels markets. A couple of years ago, with commodity prices spiraling, there was great concern that fuel markets were outbidding food and feed markets for edible biomass. Now, reporter Judy Keen notes that the United States is facing drought in nearly 80 percent of the country's corn-growing area; and more of the country's landmass is facing drought than any time since 1956.

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on energy security:

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on energy security:

As a domestic, renewable source of energy, ethanol can reduce our dependence on foreign oil and increase the United States' ability to control its own security and economic future by increasing the availability of domestic fuel supplies. By displacing hundreds of millions of barrels of imported oil, the increasing reliance on domestically-produced ethanol is making available billions of dollars for investment in domestic renewable energy technologies.

Energy Security has More than one Parameter

There's a grain (sorry) of truth in this argument. Being able to put ethanol into vehicles instead of gasoline provides a bit of competitive leverage against oligopolistic petroleum suppliers. The leverage, however, is fairly limited. The US Congressional Research Service recently concluded that

Despite the fact that ethanol displaces gasoline, the benefits to energy security from ethanol remain relatively small. While roughly 40% of the U.S. corn crop was used for ethanol in 2011, the resultant ethanol only accounts for about 7% of gasoline consumption on an energy-equivalent basis. Expanding corn-based ethanol production to levels needed to significantly promote U.S. energy security is likely to be infeasible.

Fuel substitution is only part of an energy security picture though, and it is important to look at the security issue holistically. Supply security also matters. And, just as world events disrupt oil supplies causing price shocks and dislocations, so too can the supply of biofuels be disrupted. Here's what I wrote on the issue six years ago (p. 58):

Biofuels do offer a diversification benefit, inasmuch as they may be less vulnerable to the same kinds of disruptions that threaten supplies of petroleum from politically unstable regions of the world. However, the cost per unit of displacement [i.e., subsidies per gallon of oil displaced] is very high, and there are likely many more efficient means to achieve the same end. Moreover, the feedstocks from which biofuels are currently derived are also vulnerable to their own set of unmanageable and unpredictable risks, such as adverse weather and crop diseases.

It turns out that those "unmangeable and unpredictable risks" are not something that should be ignored. The chart below is from a 2007 article by Bruce Babcock at Iowa State University, a frequent researcher on corn and biofuels issues. He notes that corn harvests have regularly deviated from expected yields, and often by a large margin. Shortfalls are particularly relevant with respect to biofuels markets that mandate particular consumption levels. Responding to claims that crop innovation had made corn at a lower risk from drought than in the past, Babcock was skeptical:

It is an open question whether future supply shocks will follow the historical patterns. Many feel that current corn hybrids are better able to withstand hot and dry weather of the type seen in 1983 and 1988. This has yet to be demonstrated, though, as we have not had a severe drought since 1988. Dry weather in Illinois in 2005 and in the western Corn Belt in 2002 caused significant local yield losses, which suggests that corn crops remain vulnerable to drought.

Supply Shortfalls in the Face of Mandated Consumption

As crop production is threatened, food prices and crop futures rise. The higher prices send signals to all consumers that they might want to shift to other feedstocks or to figure out how to use the now more-expensive inputs more carefully. This rationing process works best when all consumers of the affected commodity feel pressure to substitute or conserve. Biofuel mandates mess up this process because they require diversion of a large portion of the corn crop into vehicle fuels -- even at very high prices. In effect, the mandates hard-wire the markets so that transport uses for corn will outbid feed and fuel uses.

In an interesting review of corn market dynamics under the present drought, Darrel Good and Scott Irwin at the University of Illinois point out that compliance with the blending mandates does have some flexibility. The rules allow some banking of prior year credits. This carryover has been estimated at "at least 2 billion gallons" -- important, but still a small slice of the more than 13 billion gallons required for blending during the next mandate year. Thus, when they estimated how markets would respond to rising corn prices, they assumed that carryover stocks of Renewable Indentication Numbers (commonly referred to as "RINs," and which are the market mechanism for tracking compliance with the RFS biofuel blending mandates) would be used first to reduce the need for buying actual (and expensive) corn. This makes logical sense, but only solves part of the problem. Good and Irwin further note that

without policy changes ethanol use after the stock of RINS is used up would become perfectly price inelastic.

Becoming "perfectly price inelastic" is economist terminology that means fuel markets will continue to buy the same amount of ethanol no matter how much the price of the fuel rises. This is a big deal, because it means the residual demand for ethanol for fuel will outbid all other uses for corn during the period of scarcity: food, animal feed, exports, everything. And this will happen only because of the Renewable Fuel Standard subsidy, not because of the inherent economics of the product.

Good and Irwin point out that the ability to borrow credits from future years (up to 20% of the requirement) could theoretically be used to further reduce the need to buy actual corn for fuel markets. However, they didn't see this strategy being widely deployed. Borrowing for 2012/13 would mean the need to blend even more than the mandate for 2013/14 -- yet markets are already saturated with ethanol making incremental blending quite difficult.

The drought brings into greater focus problems that have existed in biofuel markets for some time. First, that biofuel feedstocks, like oil, are subject to supply disruptions and this volatility reduces the security element of the fuel. Second, that the mandates result not only in market challenges but a moral one as well when the least important end-use from a societal stand point (fuel for cars) ends up diverting increasingly scarce supplies of corn or other biofuel crops from feeding people.

Ships Passing in the Night

Lest the mandated use of corn in cars rather than for food not cause enough heartburn, Tim Wise highlights another problem on his Triple Crisis blog. While reducing carbon impacts was an early (though not always accurate) selling point of biofuels, current policies have resulted in Brazil and the United States shipping each other ethanol at the same time. Here's Wise:

Why would the United States, which now devotes 40% of its corn crop to the production of ethanol, import more than 4 billion gallons of ethanol from Brazil? And why would Brazil at the same time import a projected 2 billion gallons from the U.S.? Couldn’t we just save all those transactions costs and shipping-related greenhouse gas emissions by keeping our ethanol and cutting our projected ethanol imports from Brazil in half?

Not if your goal is to game the U.S. biofuel mandate.

The driver is the fact that corn ethanol and sugar ethanol are fall into different categories of the RFS. Sugar-based fuels, because they supposedly have a lower carbon footprint, fall into a more constrained, and therefore more valuable, category of RINs. Wise notes that

...the ultimate perversity is the ethanol-for-ethanol trade between the U.S. and Brazil. Under the FAO-OECD’s baseline scenario, Brazil would import 2 billion gallons of corn ethanol from the United States. Why, if it’s a major ethanol exporter and it produces more environmentally sustainable ethanol? To make up for the domestic shortfall created by its exports to the U.S., and to meet its own rising demand from its expanding fleet of flex-fuel cars. They’ll take our low-grade corn ethanol if they can get a higher price for their sugar-based equivalent.

And so it goes.

Just Pass the Wine

The inanity of it all is a bit mind-boggling. But then I remember it has always been so in this nook of our global marketplace. My first introduction to ethanol issues was in 1989 when I worked on an ethanol-related US trade case. It turns out that Europe was producing too much wine due to their complex and wide reaching system of agricultural subsidies. Wine can also be used to make ethanol fuels, and even then the US had generous subsidies for blending ethanol with gasoline. Alas, the ethanol-from-wine couldn't come straight to our shores because then we'd have been flooded with supplies from around the world, and that would have hurt US corn farmers and processors. Thus, a tariff (which ended only last year) was in place to render most imports (including European wine alcohol) far less competitive.

To solve the problem, the wine was instead shipped first the Carribean basin, which due to a regional economic development plan passed by Congress earlier, had special tariff-free access to US markets. But to comply, some value-added had to be done to the fuel in the Carribbean -- it couldn't just be transhipped. So it was dewatered there, and entered our markets tariff-free where it was blended with our gasoline supplies to "green" our transport fleet.

How much easier it would have been if they'd just offered us the wine.

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on

Back in 2006, biofuel proponents were touting the introduction of ethanol as a boon for domestic energy security. National security was one of the central planks proponents used to advocate for continuing large and growing subsidies to the fuels. The industry continues to highlight the energy security angle. Here is the Renewable Fuels Association on

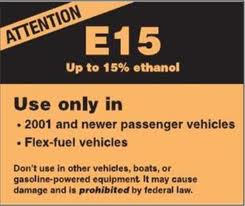

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?