Bjorn Lomborg ran an op-ed in the Wall Street Journal a few days ago in which he concluded the real problem with energy markets is that there are too many subsidies to green energy. Lomborg argues that people who complain about subsidies to fossil fuels are in part misguided by the considerable "misinformation" on the subject, and he aims to "debunk" key "myths" around the numbers. While he agrees that fossil fuels shouldn't be subsidized either, his main focus is on government largesse to renewables.

As I've been working on this subject for quite a long time, I've added some commentary to his commentary ("Green energy is the real subsidy hog",WSJ, Nov. 11, 2013). His op ed is reprinted verbatim below. My commentary is interspersed, with the text indented and italicized.

*******************************

Green energy is the real subsidy hog

For 20 years the world has tried subsidizing green technology instead of focusing on making it more efficient. Today Spain spends about 1% of GDP throwing money at green energy such as solar and wind power. The $11 billion a year is more than Spain spends on higher education.

Perhaps a quibble, but the duration of subsidies, even to renewables, is a good bit longer than 20 years. The longevity matters, as it is a rough proxy for how entrenched the related interests are, and of the political challenges that any reform effort faces. Corn ethanol, if one is bold enough to call it "renewable," has been subsidized for 35 years in the US. A handful of renewable subsidies go back even further, to the period immediately following the first energy crisis of 1973, as the US floundered around trying to address its suddenly-revealed overdependence on imported oil from hostile nations.

But the dollars to renewables were quite small until the early 1990s, and become mere rounding errors for that time period once one removes (as I believe they should) support to corn ethanol and large scale hydro plants. In contrast, and since Lomborg is focused on expensive support for energy globally, subsidies to oil and gas date back at least a century. Further, since oil is a complex global market, subsidies in one country often spilled over to oil operations in multiple countries. Multinational oil companies, for example, established complex (and quite impressive in a tax-wonk sort of way) mechanisms to use tanker subsidiaries and transfer prices to avoid much of their worldwide corporate tax burden. Glenn Jenkins of Harvard wrote a fascinating paper reviewing tax subsidies to international oil operations in the 1960s and 1970s, including the tanker subsidiary scheme that moved profits out from high-tax end-market countries to tax havens such as Panama and Liberia.

This was not the only such scheme, and paring them back (they are still not gone entirely) took many years of effort by taxing authorities. But the example provides an important reminder that the clock on subsidy-related distortions in energy markets has been running for a good deal longer than Bjorn Lomborg has been paying attention to it. Subsidies to nuclear fission around the world highlight this as well. From R&D to construction, accident liability, decommissioning, and long-term radioactive waste management, large government subsidies have propped up the industry since the earliest days of the civilian program in the 1950s. Without these subsidies, it is doubtful that more than a handful of reactors would ever have been built. Dollars (and all sorts of other currencies as well) have been thrown at these technologies for decades, often in big gobs.

Lomborg is correct that energy efficiency has normally been short-changed in energy policies the world over (my own figures for that late 1980s found $35 in supply side subsidies for each $1 in end-use efficiency support; the numbers are hopefully a bit better now). Perhaps this is an unfortunate side-effect of the dynamics of political economy: supply-side resources tend to have large infrastructure, concentrated cash flows, and executives who can promise jobs for the district and funding for the re-election coffers. In contrast, efficiency more often comes in small, dispersed batches without the political fanfare of a ribbon cutting.

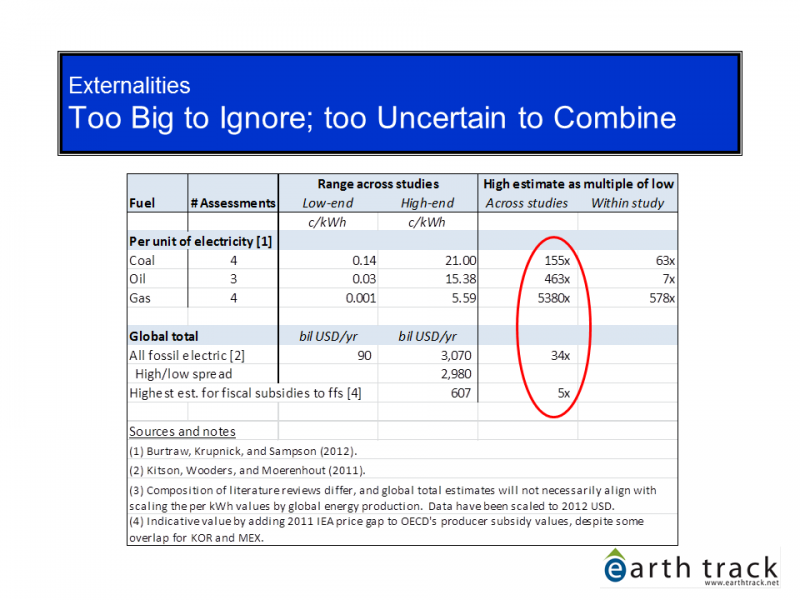

But there is another very important reason that efficiency has not been front-and-center around the world: existing policies have consistently underpriced conventional energy resources - through subsidies to be sure; but also through large negative externalities that have long been ingnored. This Harvard Medical School study, for example, pegged environmental and health costs of US coal alone at hundreds of billions per year. And ignored externalities mean artificially low delivered prices for fossil fuels, and systematic underinvestment into improved efficiency and conservation. Lomborg may disagree on the figures used by the IMF, but he should certainly agree that negative externalities are quite large and have not been properly internalized into many fuel markets.

At the end of the century, with current commitments, these Spanish efforts will have delayed the impact of global warming by roughly 61 hours, according to the estimates of Yale University's well-regarded Dynamic Integrated Climate-Economy model. Hundreds of billions of dollars for 61 additional hours? That's a bad deal.

Wow, 61 hours does seem a bad deal. For the billions of dollars being spent, I would think we ought to be able to stave off destruction for at least a couple of weeks, maybe even a month or two. But would it be out of line to suggest that these figures seem so extraordinarily precise given the forces at play that perhaps this type of conclusion might not be playing to the core strengths of what the Yale model was set up to evaluate? We've got time horizons that are decades long, interacting policies not only among many global players in the solar space, but across fuels and competing economic drivers of energy policy such as energy security and jobs. And we've got newer technologies that quite often have discontinuous (i.e., involve tough-to-model non-linearities) and hard-to-predict development and technology dissemination paths. In light of these factors, I'm hard-pressed to ascribe serious weighting to the 61 hour prediction. What is likely going on is that the impact of a tiny policy is being evaluated in isolation against the inertia of a massive global system. Not surprisingly, it doesn't move the needle much. No single policy would.

This issue arose in the mid-1990s when the US Environmental Protection Agency ran two macro models (Decision Focus and Jorgenson/Wilcoxen) to see how removing a handful of individual subsidies to oil would affect national emissions of greenhouse gases. The answer, for the same reason, was not much. Though when they redid the model runs looking at a bigger list of fossil fuel subsidies (i.e., beyond the scoping problems of the EIA reports and removing a group of subsidies together rather than one or two at a time), emissions shifts from reform became more material. Unfortunately, this exact same error was repeated in a recent assessment by the National Academy of Sciences of the US tax code and ghg emissions. In contrast, the OECD has been assessing the impact of fossil fuel subsidy reform on emissions for well on a decade using its general equilbrium model, and has found material benefits.

Are some renewable energy policies inefficient? Of course -- just like most of the other subsidies given. With a feed-in tariff, the subsidy can be set too high, applied to too many kWh, or set to last for too many years. But at least there's no payment unless power is delivered. Goofy ideas like Senator Lindsey Graham's push to guarantee $100 billion in loans to build new nuclear reactors cost money even if the projects balloon in price, get cancelled, and never generate a single kWh. He and others pretend that loan guarantees, no matter how big, are free; financial economists know better.

If Spain's renewable subsidies have been inefficient they should fix them. If they are too expensive for their economy, they should pare them back, redirect, or eliminate. That's part of running a competent government. But let's not imply (as Lomborg's juxtaposition in the first paragraph of his oped does) that somehow the PV subsidies are a material reason Spain is not spending enough on higher education. Clearly, there are many things about the Spanish economy that seem sub-optimal in attaining better lives for its citizens. I'd put its long-standing underemployment of the country's young people (youth unemployment recently topped 56%) far higher on the list of things having detrimental effects on the development of the country than whether they've optimized their subsidies to photovoltaic installations.

Stepping outside the Spanish example for the moment: the costs of solar panels have continued to decline sharply, and quite interesting financial models for deploying them have evolved as well. They are increasingly being integrated into basic building materials, which should bring the marginal cost of the power component down still further. If these panels are one day competitive even according to Lomborg calculations, would the Yale model somehow parse out 61 hours worth of credit for this shift to the Spanish subsidies? I don't know whether these economic gains will actually occur any more than Lomborg does. Yet, with production lot sizes in the many thousands for PV panels, spillover from related industries, and frequent reinvestment in production lines, I am far more hopeful that incremental innovation in the PV sector will generate significant cost and value improvements than I am about similar claims by the nuclear industry, where even in France reactor lot sizes have been too small to generate the type of learning, innovation, and economies of scale needed to bring unit costs in line.

Yet when such inefficient green subsidies are criticized, their defenders can be relied on to point out that the world subsidizes fossil fuels even more heavily. We shouldn't subsidize either. But the misinformation surrounding energy subsidies is considerable, and it helps keep the world from enacting sensible policy.

I've done my best to call out subsidy silliness whatever fuel it supports, and have never favored cutting any energy resource slack on the negative impacts of its production chain. That said, I speak to many people representing all sorts of views on the best energy path, and there are notable distinctions in the messaging used by the different groups. When I speak to people in the wind or solar industries ("defenders" of green subsidies from Lomborg's vantage), they are actually quite candid that what they are getting from the government are subsidies. Not surprisingly, they believe those subsidies are justified and socially beneficial, but there is no mincing the "S" word.

This is in sharp contrast with the oil and nuclear industries and their apologists. Percentage depletion becomes just another way to write off investments - no matter that you are writing off more than you actually invested. Government loan guarantees of tens or hundreds of billions of dollars for new reactors (Lindsey Graham again) are not subsidies because there is not an initial cash payment from the government. No matter that credit enhancements are a separate product (for which one must pay) in financial markets; that they provide particularly large benefits for the most capital intensive technologies with poor construction track records such as nuclear; and that favored technologies of particular political gatekeepers are given disproportionate access to Uncle Sam's low cost credit line. Master limited partnerships, another example, are almost entirely used by the oil and gas industry to enable publicly-traded firms to escape billions in corporate income taxes each year. Yet they are brushed away as though it's not really a subsidy, just another way to organize a company.

At least give all of us working on energy market transparency and subsidy reforms the courtesy of acknowledging your industry is at the trough. Make the case on why you deserve taxpayer support, but don't pretend we're too stupid even to see it.

So yes, Lomborg and I agree that the misinformation is considerable. We differ on the source. Political dynamics would suggest that the more established industries with larger cash flows (fossil, nuclear, and the farm lobby) will be the ones most engaged in lobbying activity, political donations, and cranking out information supportive of their subsidy positions. That is the pattern I have seen.

The Wall Street Journal's editorial page, where Lomborg has published his take on subsidies, is perhaps a case in point. The paper has run numerous editorial pieces on subsidies to wind and ethanol. It has run pretty much nothing on subsidies to nuclear or to fossil fuels -- the only exceptions being postings by people claiming, as Lomberg has, that the fossil fuel subsidies are small and mostly pretend figments of crazed greenie imaginations.

Three myths about fossil-fuel subsidies are worth debunking.The first is the claim, put forth by organizations such as the Environmental Law Institute, that the U.S. subsidizes fossil fuels more heavily than green energy. Not so.

The U.S. Energy Information Administration estimated in 2010 that fossil-fuel subsidies amounted to $4 billion a year. These include $240 million in credit for investment in Clean Coal Facilities; a tax deferral worth $980 million called excess of percentage over cost depletion; and an expense deduction on amortization of pollution-control equipment. Renewable sources received more than triple that figure, roughly $14 billion. That doesn't include $2.5 billion for nuclear energy.

Lomborg is a savvy-enough economist to know exactly what he is doing with his data framing, and it is hardly helpful to the real policy issues for him to cherry pick as he does. Energy subsidies are a global problem that diverts massive financial flows from more useful endeavors, slows energy innovation, and contributes to environmental damage. The policies become de facto entitlements that are increasingly difficult to remove as recipient industries and sectors of the population become more dependent on the prevailing set of transfers or special benefits, reducing the political latitude for reform. These forces may be one explanation why in the US subsidies to wind expire every couple of years, while subsidies to oil and gas are an integrated part of the tax code that is infrequently debated and virtually never at risk of removal.

To support his assertion that this is all about wind, solar, and biofuels, Lomborg picks a point estimate, and one in a year mid-recession and just after the big cash dollops of the American Recovery and Reinvestment Act (passed in 2009) put federal spending on renewables at peak or near-peak levels. Even today, renewable numbers would likely be materially lower. The eighty-five years of industrial development between 1910 and 1995, during which renewable subsidies (other than the mega hydro dams, a topic for a different day) were barely a blip, are silently forgotten.

The economic distortions that matter in terms of overall energy market structure and societal responses to climate change are not the result of a funding surge in 2010, but of much longer term trends of support. In the late 1980s, for example, my own detailed analysis identified more than $8 of federal support to conventional fuels (fossil, nuclear, and large scale hydro) for each $1 going to renewables and efficiency, an indication of the skewness of these earlier eras. Using a longer-term trend line provides a more accurate framing of government subsidies and also mitigates some of the lumpiness that accrues to one fuel or another at different periods of time.

It is also important to note that Lomborg is relying entirely on subsidy estimates produced by the EIA, though EIA's subsidy reviews unfortunately have an array of scoping and estimation problems. This is an issue I have tracked in a fair bit of detail over the years (see a full discussion in this paper); and that EIA at least partly acknowledged in its most recent subsidy review (though not all of their explanations ring true). It is notable that not only do EIA's figures for total subsidies rise sharply when the topic is evaluated more systematically, but the relative support across fuels shifts dramatically as well.

Actual spending skews even more toward green energy than it seems. Since wind turbines and other renewable sources produce much less energy than fossil fuels, the U.S. is paying more for less. Coal-powered electricity is subsidized at about 5% of one cent for every kilowatt-hour produced, while wind power gets about a nickel per kwh. For solar power, it costs the taxpayer 77 cents per kwh.

Just as one can't properly measure a company's strength and prospects based on a single financial metric, the efficacy of energy subsidy policies - indeed of most government policies - must be evaluated with a mix of metrics as well. Thus, it is useful to supplement gross dollars of subsidy for a particular fuel with other metrics, as Lomborg has done. This includes not only subsidy intensity (subsidy/unit energy produced), but other potential metrics of interest such as subsidy per mt of CO2-equivalent avoided or the subsidy per job-year created (raw jobs rather than job-years are a far less accurate measure of longer-term benefits). The most relevant metrics will depend on the structure of the market being evaluated and the political justifications on which a subsidy program is being proposed.

In his article, Lomborg chooses to emphasize primarily subsidy per kWh of energy produced. It is a useful rubric, but only within the proper context. Applying it to subsidies supporting basic energy R&D would not be useful, for example, since commercial production from that research would not be expected until many, many years later. Time period issues can remain even for resources further along into commercial production, though still in the earlier period of infrastructure scale up. In these situations, the base over which early subsidies are being spread may still be small, generating very large subsidy intensity metrics. Further, distributed power resources may displace some power transport or distribution investments; where this occurs it is important that subsidies be compared across fuels on a similar basis that takes this savings into account. The point at which a resource moves from one category to another is not a precise one, but the issue is relevant for how much weight to put on the reported subsidy intensity figures when assessing whether spending has been productive or not. That said, even with emerging technologies far from commercialization, the subsidy metrics can help identify more cost-efficient mechanisms to achieve the same endpoints. This is particularly true where expensive energy resources are being touted as the best or only solution to a problem for which there are actually many potential solutions -- reducing greenhouse gases for example. If reductions in carbon are available at a few dollars per mt abated, the government shouldn't be earmarking subsidies to favored industries that cost a few hundred dollars per mt.

The subsidy intensity figures in Lomborg's op-ed suffer most from his use of a peak-year point estimate, which exacerbates the bias from using the peak year in his gross subsidy figures. This is because both parts of the intensity fraction are distorted: the denominator (kWh generated) remains small due to the scale-up period of the technology while the numerator ($ of subsidy) surges through selection of peak-year support.

Finally, if the subsidy input data is inaccurate, incomplete, or otherwise biased (as the EIA figures are), not only will the absolute subsidy intensity values be wrong, but their relative values will also be skewed.

Critics of fossil-fuel subsidies, such as climate scientist Jim Hansen, also suggest that the immense size of global subsidies is evidence of the power over governments wielded by fossil-fuel companies and climate-change skeptics. Global fossil-fuel subsidies do exceed those for renewables in raw dollars-$523 billion to $88 billion, according to the International Energy Agency. But the disparity is reversed when proportion is taken into account. Fossil fuels make up more than 80% of global energy, while modern green energy accounts for about 5%. This means that renewables still receive three times as much money per energy unit.

But much more important, the critics ignore that these fossil-fuel subsidies are almost exclusive to non-Western countries.

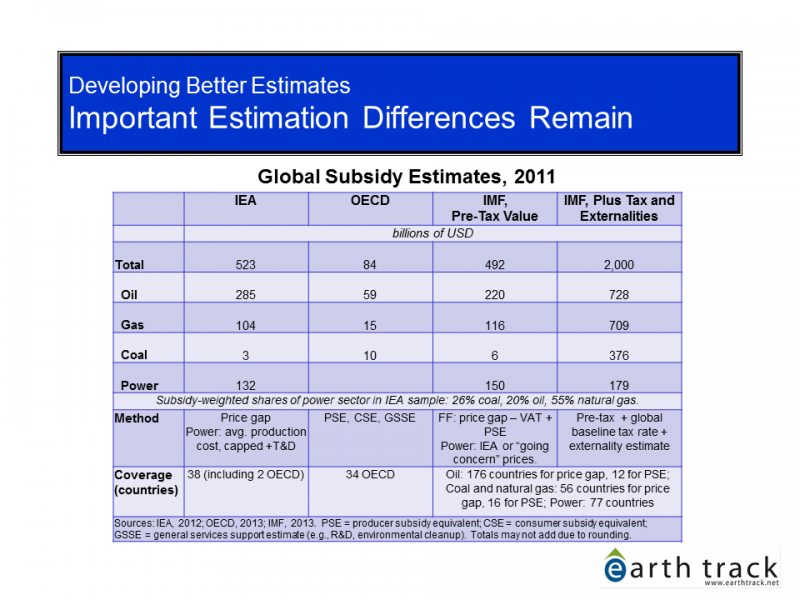

There are some subsidy estimation methodology issues here that are relevant to addressing Lomborg's conclusions. IEA measures subsidies in many countries at once using the "price gap" method. The approach evaluates variation between transport-adjusted domestic prices and a world reference price for the same fuel, an efficient mechanism and a necessary simplification given the scope of geography to be evaluated by the IEA's relatively small staff. The metric primarily captures subsidies to consumers, as subsidies to producers are often absorbed in other ways (higher economic rents to resource owners, higher returns to producers, or simply allowing an inefficient producer to continue producing at particular prevailing world price levels rather than shutting down). This "leakage" on the producer side means that the many fiscal supports don't show up as price disparities. For more than you probably ever wanted to know about the price gap approach, see this paper.

To be clear: consumer subsidies are certainly more common in non-Western countries as Lomborg notes. However, these countries also provide a slew of subsidies to fuel producers that don't get captured by IEA's data either. Further, Lomborg's conclusion that subsidies by Western countries don't matter is simply wrong. In fact, although Western countries are not trying to systematically hold domestic fuel prices below world reference prices as those topping the IEA fossil fuel subsidy tally do, they nonetheless have thousands of subsidies to fossil fuel producers that flow not only through their federal system, but through state, provincial, and municipal administrations as well. And there are also consumer subsidies in the West, though of a different form than what one sees in Iran or Saudi Arabia. Most often, these come via generous exemptions for fuels from standard sales and use taxes. These exemptions depress the economic return on investments in efficiency and conservation while stripping state Treasuries of hundreds of millions of dollars in revenues each.

There has never been anything close to a full inventory of energy subsidies around the world. The OECD has begun building an inventory of producer subsidies within its member countries, though much remains to be done. Sub-national coverage barely exists, and coverage of producer subsidies in developing countries is also quite weak. Major gaps in the identification of credit supports to energy extraction and infrastructure are also common globally. Having looked in detail at many of the data sources on which Lomberg relies, I would suggest that his conclusions on the relative levels of support across fuels are premature, and become even more so were one to include negative externalities of energy rather than just fiscal subsidies.

Twelve such nations account for 75% of the world's fossil-fuel subsidies. Iran tops the list with $82 billion a year, followed by Saudi Arabia at $61 billion. Russia, India and China spend between $30 billion and $40 billion, and Venezuela, Egypt, Iran, U.A.E., Indonesia, Mexico and Algeria make up the rest.

These subsidies have nothing to do with cozying up to oil companies or indulging global-warming skeptics. The spending is a way for governments to buy political stability: In Venezuela, gas sells at 5.8 cents a gallon, costing the government $22 billion a year, more than twice what is spent on health care.

Lomborg oversimplies here, though clearly fuel pricing in Venezuela makes no rational sense. The consumer subsidies are certainly partly about buying stability - a modern day form of bread and circuses. But it is also true that big national oil companies can be strong advocates for entrenched leaders and their parties; and that the patronage associated with the firms and their cash flows is a powerful drug that generates all sorts of perverse outcomes in the politics and economics of the affected countries. The subsidies can also get intertwined with sometimes misguided development dreams. Using inexpensive power inputs to finance (over) expansion of irrigation in India, or to build "higher value" petrochemicals production, perhaps without making sure the infrastructure was globally competitive even were it to pay world prices on the fossil fuel feedstocks. Real estate infrastructure can also suffer, as underpricing of heating, cooling, and lighting services lead developers to put up long-lived structures without appropriate investments into the energy efficiency of the building systems and envelope.

Subsidies on the producer side in many of these countries are also endemic, though often much more difficult to track: favorable terms on extraction, tax breaks, inexpensive government-provided capital or insurance. And who gets them and how much absolutely does involve some degree of cozying up to the power brokers.

A third myth is propagated by a recent International Monetary Fund report, "Energy Subsidy Reform-Lessons and Implications." The organization announced in March that it had discovered an extra $1.4 trillion in fossil-fuel subsidies that everyone else overlooked. Of that figure, the report claims, $700 billion comes from the developed world.

U.S. gasoline and diesel alone make up about half of the IMF's $700 billion in alleged subsidies. Gasoline and diesel deserve more taxation, the report says, so the IMF counts taxes that were not levied as "subsidies." Thus air pollution merits a 34-cents-per-gallon tax, according to the IMF models, while traffic accidents and congestion should add about $1 per gallon.

There are a few issues here. First, I hope that Lomborg is upset with the IMF methodology or values, and is not viewing any recognition of energy-related external costs as a "myth" that needs "debunking". The valuation of externalities is often contentious though, and addressing the fiscal subsidies alone is often sufficient to alter the direction of energy markets in useful ways. Thus, it is helpful to segregate the two values, and to assess reform impacts both on fiscal subsidies alone, and fiscal plus externalities as a separate model run.

That said, the basic idea that exemptions for energy fuels and services from basic levels of taxation applied to other good and services are unwarranted and should be viewed as subsidies is a sound one. This is a significant subsidy both in countries with VAT (as energy often receives lower rates) and at the state level here in the US (where exemptions from sales and use taxes are common for fuel).

According to the IMF, the U.S. also should have a 17% value-added tax like other countries, at about 80 cents per gallon. The combined $350 billion such taxes allegedly would raise gets spun as a subsidy.

Let's ignore the question of whether or not the US should have some national VAT imputed, as even within our existing tax framework there are subsidies of import that should be fixed. For example, federal motor fuel taxes are used almost exclusively to fund highway construction and maintenance. And exemptions or reductions from those taxes for particular classes of users results in literal free riders. Favored classes have included vehicles using ethanol (until the excise tax exemption was replaced with a tax credit), and to a lesser degree electric or hybrid vehicles that have decoupled the connection between conventional fuel consumption and highway usage. There are also large cross-subsidies to heavy trucks from other classes of users, as the heavier vehicles cause a disproportionate share of road damage. And, all users underpay highway costs by close to $100 billion per year. The vast majority of this undercharge (less the tiny fraction of vehicle miles not propelled by petrol) benefits oil.

While the US doesn't have a VAT, as already noted we do have sales and use taxes on consumption in most states. And it is certainly true that if fuel excise taxes are earmarked at the state level to (mostly) pay for roads, and all sorts of other goods and services pay the sales tax, the absence of a sales tax on gasoline or diesel is properly viewed as a subsidy. So too for commercial and residential consumption of fuels that are mostly exempt from state sales tax across the country - a policy that is both enormously costly in the states I've looked at, and certainly marginalizes activities that make the economy more energy-efficient.

The assumptions behind the IMF's math have some problems. The organization assumes a social price of carbon dioxide at five times what Europe currently charges. The air-pollution damages are upward of 10 times higher than the European Union estimates. And what do traffic accidents have to do with gasoline subsidies?

I agree with Lomborg on the issue of traffic accidents. But his critique of the value assumptions for the social cost of carbon is a bit dicier, given the malfunctioning European carbon market. Further, just as market impacts are better evaluated with a multi-year subsidy average than a point estimate, integration of external costs should also be done with longer-term estimates, rather than using only the spot price at a particular point in time.

Finally, the IMF effectively ignores the 49.5 cents per gallon in gasoline taxes the U.S. consumer actually pays. The models cancel out this tax, inexplicably, with an "international shipping cost." But even if you accept the IMF's estimated pollution costs and the European-style VAT, the total tax the IMF says goes uncollected comes to only about 44 cents per gallon-or less than the actual U.S. tax of 49.5 cents per gallon. The real under-taxation is zero. The $350 billion is a figment of the IMF's balance sheet.

The baseline taxation of energy should (1) compensate public sector owners for the sale (severance) of valuable energy resources; (2) recover public sector costs associated with the public provision of energy-related services (such as regulatory oversight, site cleanup, excess road repairs); (3) equal the baseline tax on other commodities (so fuel taxes actually contribute to general revenues rather than just paying for the excess costs they put on the system); and (4) charge an appropriate levy for negative externalities associated with production and use of the resource. This is in addition to removing obvious subsidies to production or consumption for a particular fuel. Many assessments of energy taxation, including Lomborg's, fail to incorporate appropriate measures for baseline levels. As noted above, for example, we know that the US federal tax on motor fuels doesn't even cover the related infrastructure. At the state level, tax exemptions for fuels are rife; and excise and severance taxes often earmarked to fund the special problems or costs that extractive operations create for the state (resulting in little or no net contributions to general state spending). Lomborg may be correct in some of his criticisms of IMF assumptions, but he is clearly wrong in his conclusion that "the real under-taxation is zero."

Inaccurate information of this sort is needlessly misinforming public policy. I'm in favor of ending global fossil-fuel subsidies-and green-energy subsidies. Subsidizing first-generation, inefficient green energy might make well-off people feel good about themselves, but it won't transform the energy market.

Lomborg has a large megaphone, and cachet with many fiscal conservatives and green energy skeptics. If he really is in favor of ending global fossil-fuel subsidies, I would love to see him actually work in that direction. Too often when people say they are in favor of ending subsidies to both fossil fuels and green energy, what they really mean is that they want to define away the baseline subsidies to fossil as not really being subsidies; and then strip the subsidies to renewables and call the playing field level.

Green-energy initiatives must focus on innovations, making new generations of technology work better and cost less. This will eventually power the world in a cleaner and cheaper way than fossil fuels. That effort isn't aided by the perpetuation of myths.

Dr. Lomborg, director of the Copenhagen Consensus Center, is the author of "How Much Have Global Problems Cost the World? A Scoreboard from 1900 to 2050" (Cambridge, 2013).

oject have been archived offline. Reports and commentary commissioned by Pew remain accessible via Pew's main website,

oject have been archived offline. Reports and commentary commissioned by Pew remain accessible via Pew's main website,