IEA

Fossil Fuel Subsidies: Approaches and Valuation

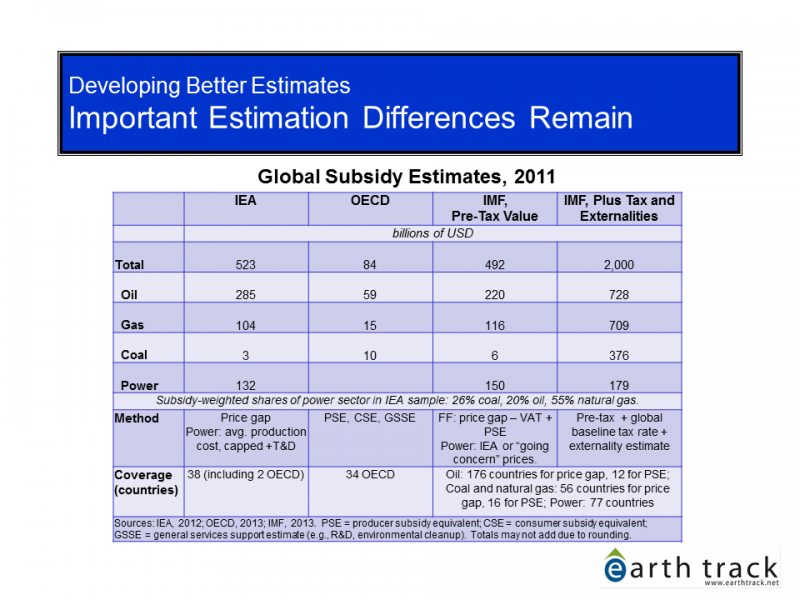

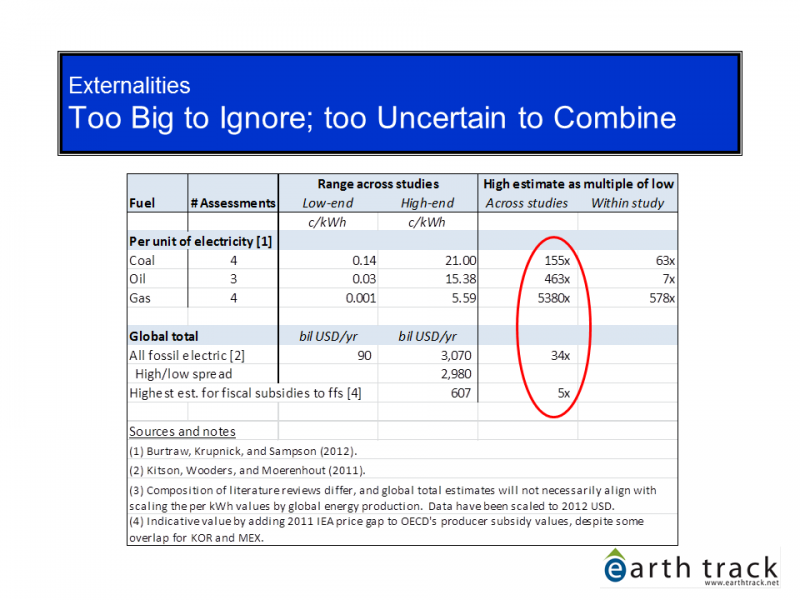

Numbers ranging from half a trillion to two trillion dollars have been cited in recent years for global subsidies for fossil fuels. How are these figures calculated and why are they so different? The most commonly used methods for measuring subsidies are the price-gap approach-quantifying the gap between free-market reference prices and the prices charged to consumers-and the inventory approach, which constructs an inventory of government actions benefiting production and consumption of fossil fuels.

Global Energy Subsidies: Scale, Opportunity Costs, and Barriers to Reform

Government subsidies to energy producers, transporters, and consumers are widespread throughout the world and represent a large public investment in the energy sector. In theory, this investment could be funding a variety of social goals such as providing the poor with access to basic energy services and addressing common environmental problems linked to energy extraction and consumption.

Although some subsidies do address these types of concerns, most either do not, or do not do so effectively.

Subsidies to Energy: A Review of Current Estimates and Estimation Challenges

Presentation at a meeting sponsored by the Energy Research Institute of China's National Development and Reform Commission and the World Bank in Beijing, China. The presentation reviews existing estimates of global subsidies to energy, including their magnitude, differences in estimation methods and assumptions, reporting trends, and emerging issues.

We are grateful to the World Bank for making a Mandarin version of this presentation available as well.

Comments and suggestions for WEO nuclear chapter and updated Nuclear Roadmap

The IEA is producing two detailed assessments on nuclear energy in the coming months. The first, a chapter in their vaunted World Energy Outlook, will examine in detail the prospects and challenges to nuclear energy going forward. The second, produced jointly with NEA, will update their Technology Roadmap series, examining options and impediments to scaling nuclear around the world.

Fossil Fuel Subsidies: Building a Framework to Support Global Reform

Keynote presentation at the Expert Workshop on Subsidies to Fossil Fuels and Climate Mitigation Policies in Latin America and the Caribbean (LAC), held at the Inter-American Development Bank in Washington, DC on January 14, 2014. Slides review recent global estimates of fossil fuel subsidies, highlighting both the tallies and the reasons the estimates differ widely from one another.